PolicyOracle is an online Information Market platform for nowcasting and forecasting future events about policy matters and indices.

Information Markets are designed and run for the primary purpose of mining and aggregating information scattered among users and subsequently using this information in the form of market values in order to make predictions about uncertain future events. IMs make use of specifically designed contracts that yield payments based on the outcome of future events. Prices of contracts can be interpreted as a measure of the probability of the event, and the metric depends on contract specifications and market design.

PolicyOracle platform is built around the notion of “wisdom of the crowds”: the collective intelligence of a group of people is particularly more accurate than an individual person. PolicyOracle collects knowledge from multiple and diverse individuals who are widely dispersed. Its web based nature renders it accessible by potentially any interested stakeholder while it supports concurrent participation.

Another important characteristic refers to the fact that participation, if desired, can be anonymous thus motivating even those individuals who usually would not be willing to participate in online platforms, to publish their knowledge. Furthermore, participants are encouraged to submit their predictions and the uncertainty surrounding them without any concern about forecast errors, as their opinion is hidden in the trading process. This can be particularly important in our case as it is possible that participants may have inconclusive information and are afraid because of their status to openly reveal their opinion.

##Design Elements:

- Contracts and pay-off mechanisms:

- Policy related questions with binary or multiple choice outcomes (i.e. answers)

– Mutually exclusive and collectively exhaustive - Contracts pay only if event outcome X happens, 0 otherwise

- Policy related questions with binary or multiple choice outcomes (i.e. answers)

- Trading Mechanism:

Based on an Automated Market Maker

– An “always there” trader willing to accept any order at specific prices

– Avoids liquidity problems in “thin” markets and large bid/ask spreads

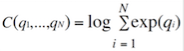

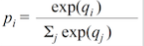

– Practically an algorithm that uses a cost function to reward or punish traders according to their performance.We use the Logarithmic Market Scoring Rules:

- Exchange Medium and Incentives:

• We use Play Money i.e. points

– Participants receive 20000 points upon registration

• Does money matter in a IM?

– Research shows that IMs are remarkably accurate, whether they operate with play-money, or real-money

##PolicyOracle’s Architecture:

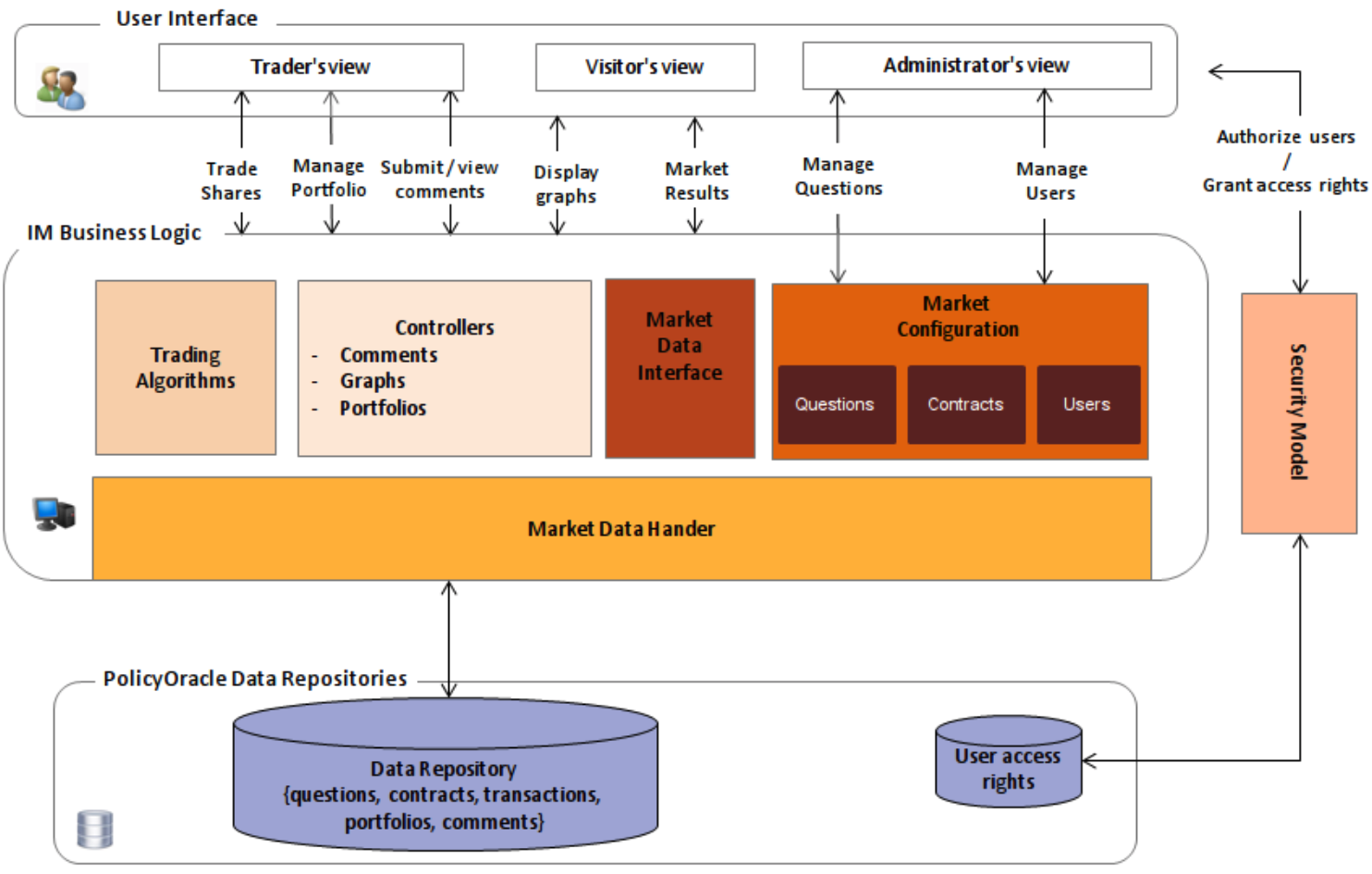

The platform is implemented using the ruby on rails web application development framework, a MySQL RDBMS.

##How PolicyOracle Works?

The user registers in the platform and receives an initial amount of 20.000 points which s/he can invest on the outcomes s/he believes will be correct by buying corresponding contracts. If the user changes its opinion due to e.g. access to new information and expect that a different outcome will be correct, s/he can modify its portfolio to express its updated opinion immediately in the market. For example, the user can sell the contracts of the outcome s/he now sees as not correct and invests on the outcome the user believes will be correct.

To use PolicyOracle, visit the following link: http://experts.policyoracle.org/

For better understanding, watch our video: https://www.youtube.com/watch?v=d5Ied1kbODI

##Follow us:

- on Facebook: https://www.facebook.com/PolicyOracle

- on Twitter: https://twitter.com/thepolicyoracle

- on Youtube: https://www.youtube.com/channel/UCjSMwpYXLNQ4G0Jc7T_x-gA

##Publications: